does wyoming charge sales tax on labor

Since books are taxable in the state of Wyoming Mary. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area.

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

The Wyoming Department of Revenue has issued a news bulletin regarding the taxability of professional services.

. In different states the term sales tax. Heres an example of what this scenario looks like. You read it correctly and other tariffs are very convenient to pay.

No you do not pay sales tax on labor. Remote and marketplace sellers. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935.

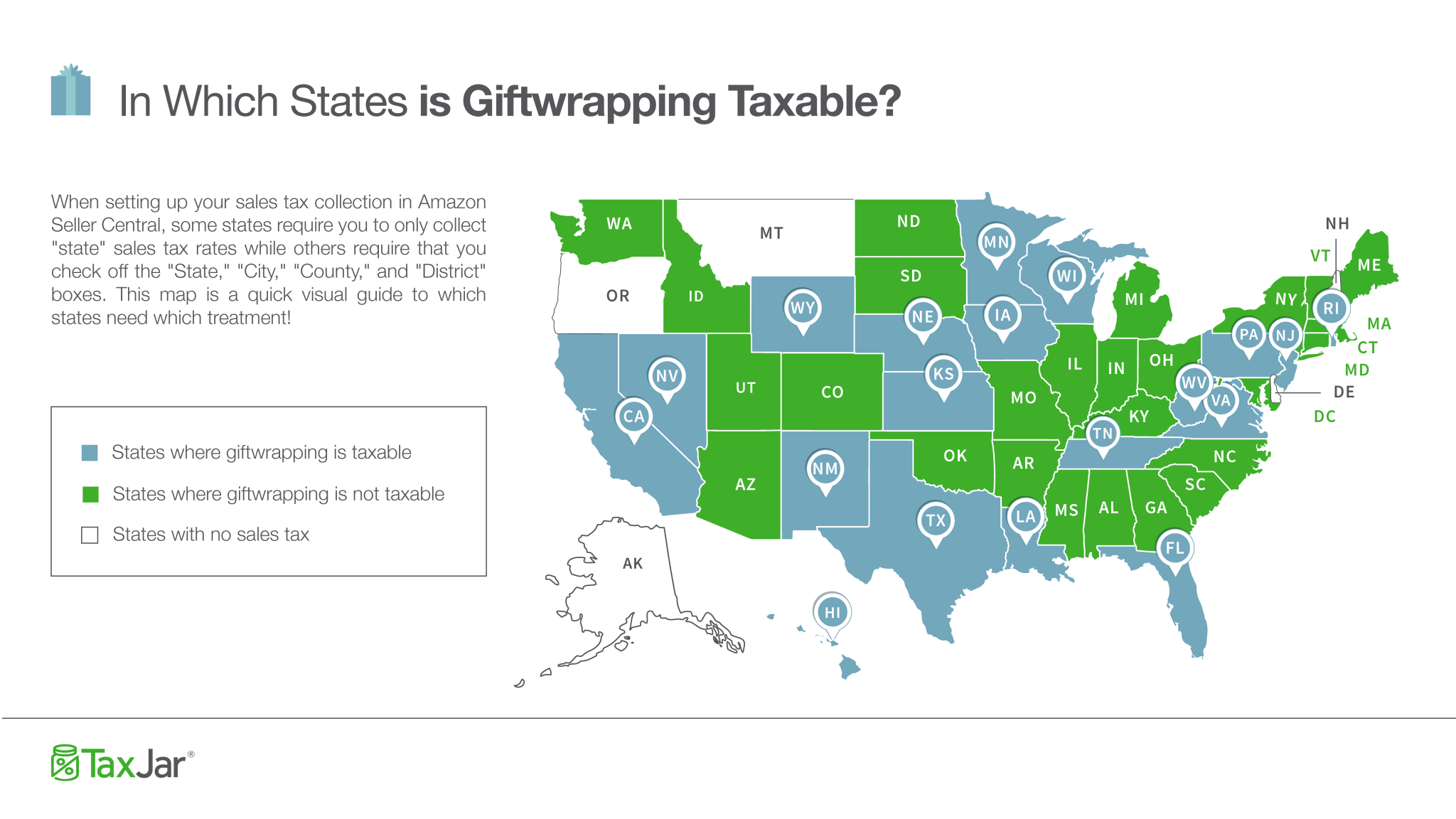

Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7. As of 2017 5 states Alaska Delaware Montana New Hampshire and Oregon do not levy a statewide sales tax. Wyoming Use Tax and You.

Also Know does the state of Florida charge sales tax on labor. You can look up the local sales tax rate. Wyoming has a 4.

We advise you to check out the Wyoming. Remote sellers and marketplace facilitators must collect sales tax from retail sales into Wyoming if they meet the. In addition Local and optional taxes can be assessed.

This is the same whether you live in Wyoming or not. The Excise Division is comprised of two functional sections. Groceries and prescription drugs are exempt from the Wyoming sales tax.

There are additional levels of sales tax at local jurisdictions too. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the. But what if we tell you there is no Wyoming income tax rate in Wyoming.

It is also the same if you will use Amazon FBA there. The state-wide sales tax in Wyoming is 4. On top of the state sales tax there may be one or more local sales taxes as well as one or.

What states do not charge sales tax on labor. In Wyoming when do you have to charge sales tax. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from. If your business has a sales tax nexus in Wyoming you must charge sales tax. Wyoming has a destination-based sales tax system so you have to pay.

Services are subject to sales tax in a number of states. So it automatically decreases the cost of living in. Does minnesota charge sales tax on labor.

Wyoming does not have a sales tax holiday. The state sales tax rate in Wyoming is 4. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

Mary owns and manages a bookstore in Cheyenne Wyoming. Under Floridas sales and use tax if no parts were used in the service and the charge was for labor only. State wide sales tax is 4.

Gold Silver Bullion Collectible State Sales Taxes

Wyoming Sales Tax Rate Step By Step Business

Faqs Wyoming Department Of Workforce Services

A Complete Guide To Wyoming Payroll Taxes

Sales Tax Exemptions Finance And Treasury

A State By State Analysis Of Service Taxability

Online Sales Tax Tips For Ecommerce 2022

Ranking State And Local Sales Taxes Tax Foundation

Sales Taxes In The United States Wikipedia

Can Wyoming S Biggest Coal Town Create A New Future Scientific American

Understanding General Sales And Use Tax In Wyoming Youtube

State Sales Tax Rates 2022 Avalara

Sales And Use Tax Explained The Business Professor Llc

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

What Transactions Are Subject To The Sales Tax In Utah

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

General Sales Taxes And Gross Receipts Taxes Urban Institute