how to calculate net debt from cash flow

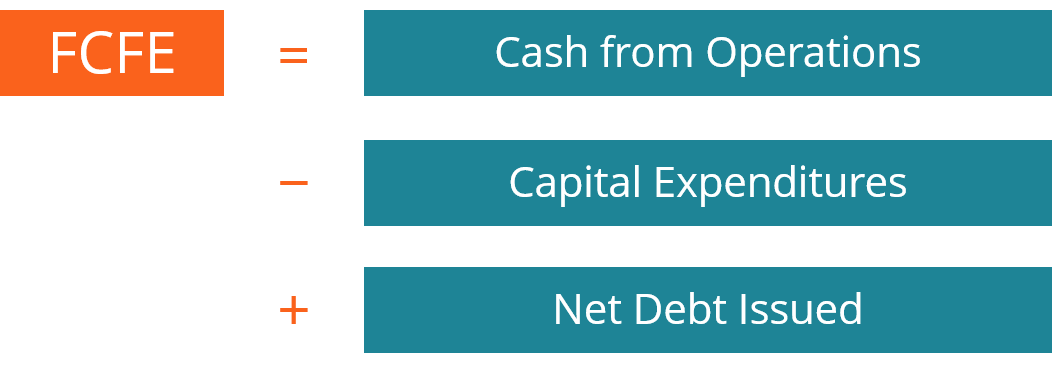

Net Cash Flow from Financing Activities. An extended formula is.

Net Debt Formula Calculator With Excel Template

How do I calculate accumulated cash flow.

. This number can be found on a. Adjust for changes in net working capital. Net Cash Flow Operating Cash Flow Financing Cash Flow Investing Cash Flow.

NCF Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financial activities. Net Asset Value NAV Calculator. Total all long-term debt listed and add the figure to the total short-term debt.

For Less Than 2 A Day Get Organized Save Time And Get Tax Savings With QuickBooks. Net Working Capital Net Working Capital NWC is the difference between a companys current assets net of cash and current liabilities net. As the DSCR is 191 it means in one year the company has generated an operating income of almost twice its debt which is very healthy.

The above formula is the most typical way to calculate net cash flow because it can be done from a cash flow statement in Excel. Free Cash Flow to Firm FCFF Calculator. Net cash flow from operating activities is calculated as the sum of net income adjustments for non-cash expenses and changes in working capital.

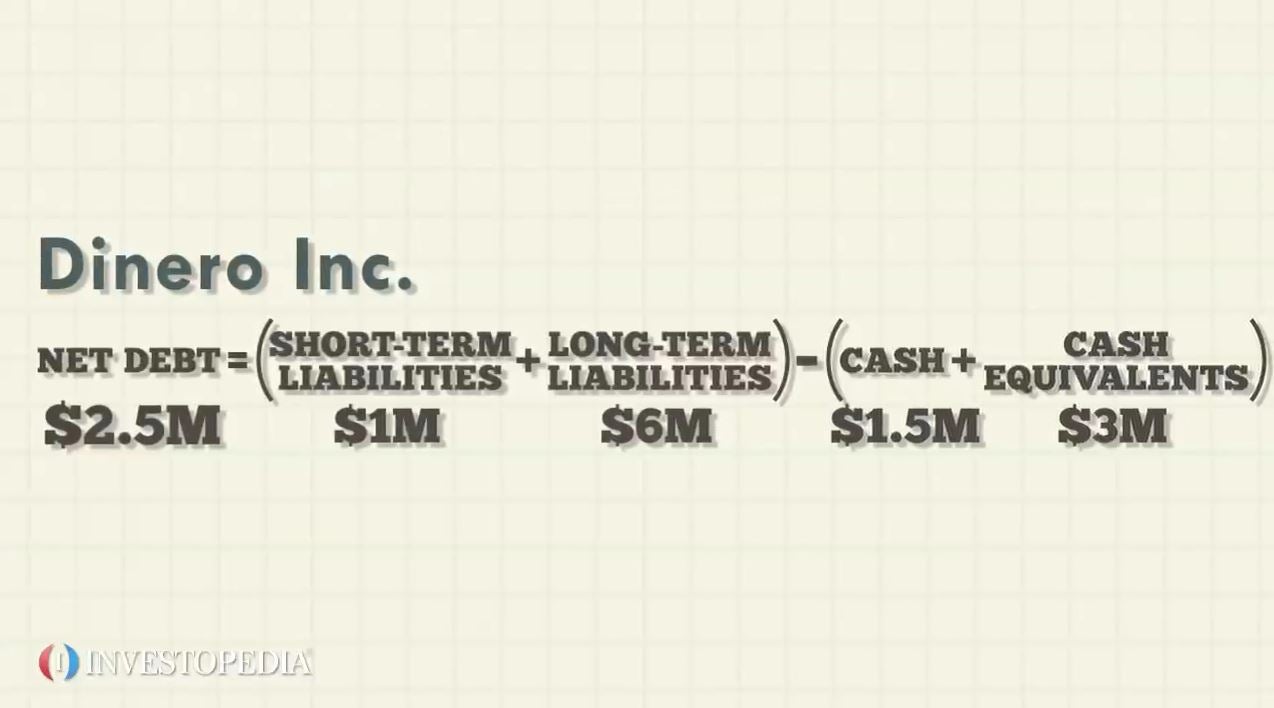

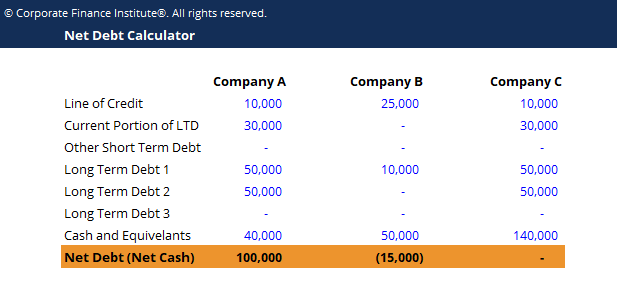

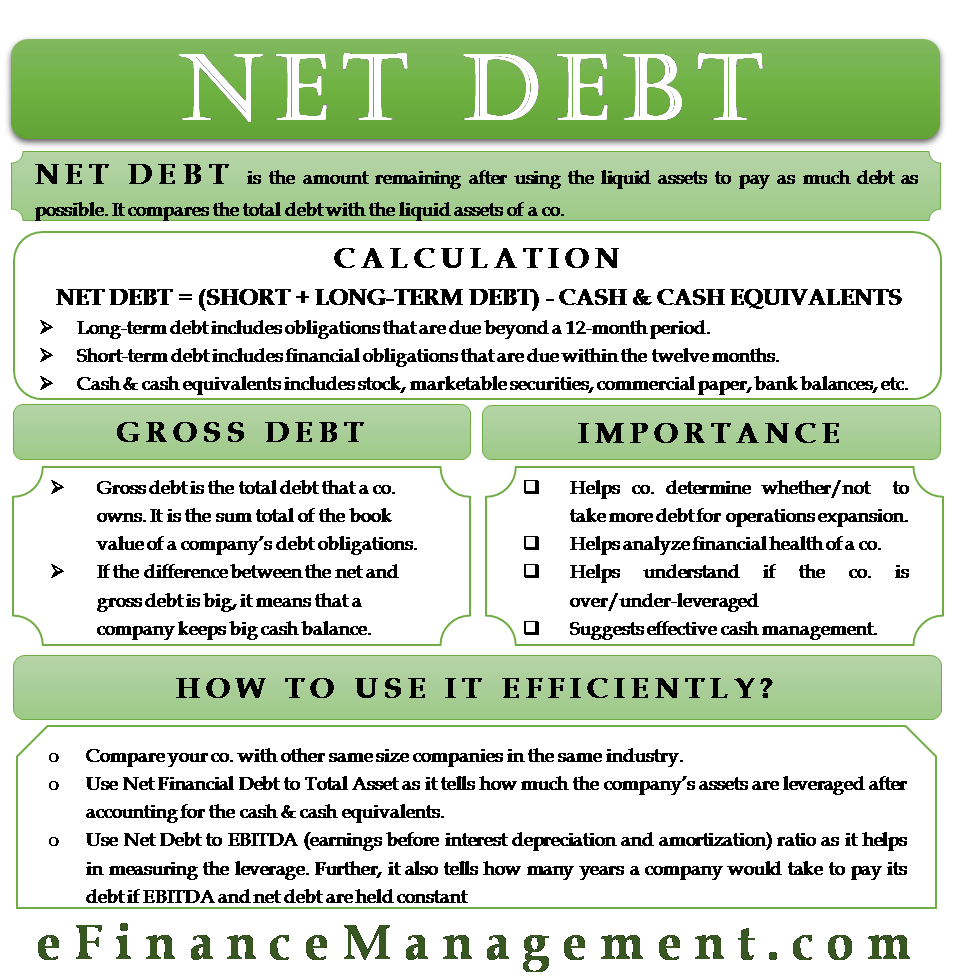

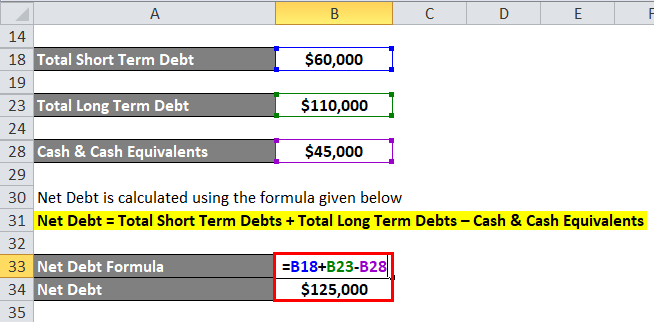

Put simply NCF is a businesss total cash inflow minus the total cash outflow over a particular period. Net cash used in financing activities of -15071 billion tells us that Wal-Mart used cash to pay interest on debt pay down debt and pay. Net Debt Short-Term Debt Long-Term Debt Cash and Cash Equivalents.

Unfortunately for small business owners understanding and using cash flow formulas doesnt always come naturally. Revenue Revenue from operations other income. Free Cash Flow to Equity FCFE Calculator.

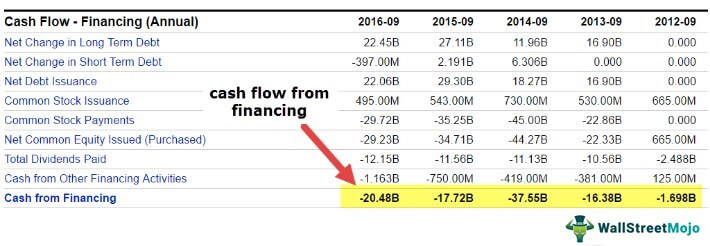

Net cash flow year one cash inflow year one cash outflow year one. How can we calculate the Operating Cash to Debt Ratio. Cash flow from financing activities refers to inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of securities like equity share preference shares issuing debt debentures and from the redemption of securities or repayment of a long term or short term debt payment of dividend.

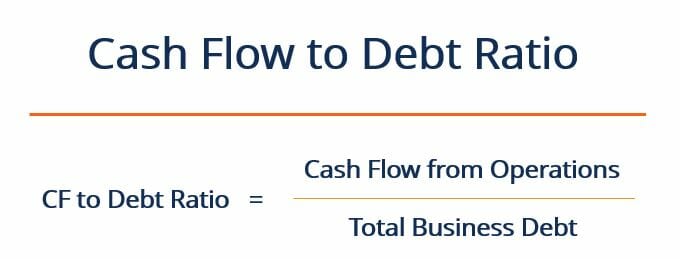

Cash Flow to Debt Cash Flow from Operations Total Debt. Gordon Growth Model GGM Calculator. Cash Flow Available for Debt Service CFADS Revenue Expenses - Net Working Capital Adjustments Capital Expenditures Cash Tax Other Items.

In theory cash flow isnt too complicatedits a reflection of how money moves into and out of your business. Cash Flow from Operations refers to the cash flow that the business generates through its operating activities. The net cash formula is given as Cash Balance Current Liabilities.

This is a simple example of calculating cash flow. Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Moreover current liabilities include all financial and non-financial liabilities.

Financial professionals calculate net cash flow with the following formula. As the name suggests this method takes into account the net income generated from operating cash flow to calculate the DSCR. Cash.

In the formula the cash balance is used to describe all cash the company holds plus highly liquid assets. Start by calculating net cash flow for each year. The net cash formula can be somewhat limited depending on the complexity of the business.

The formula for this method is. We can use the above equation to calculate the same. However other ways to calculate net cash flow include.

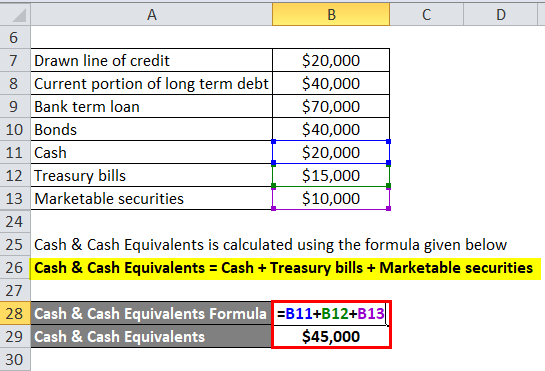

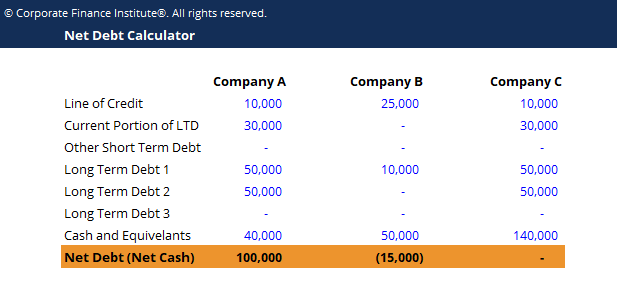

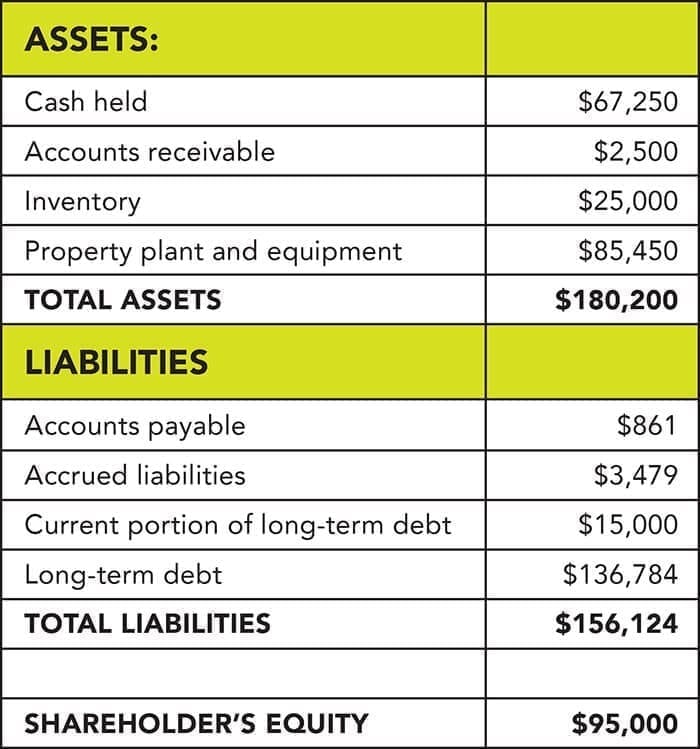

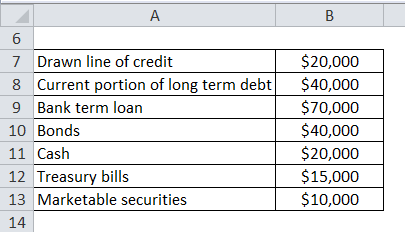

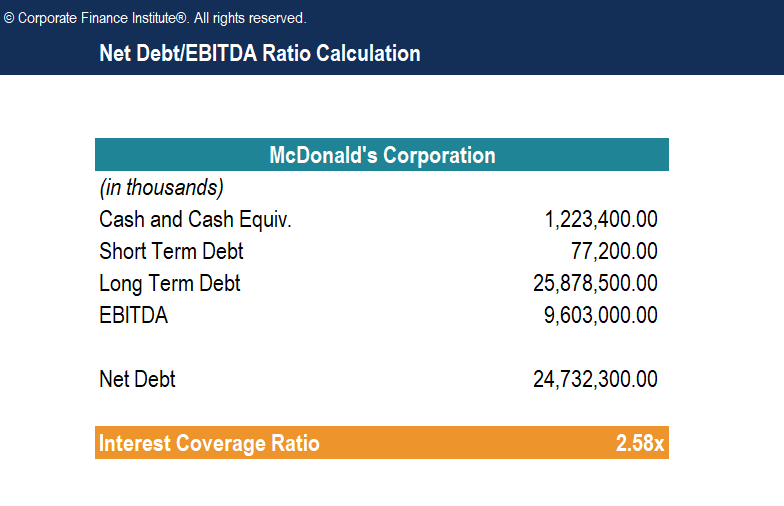

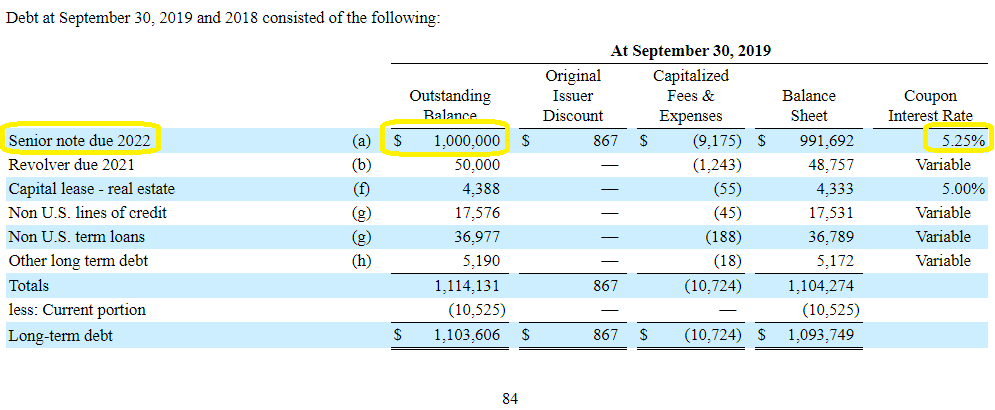

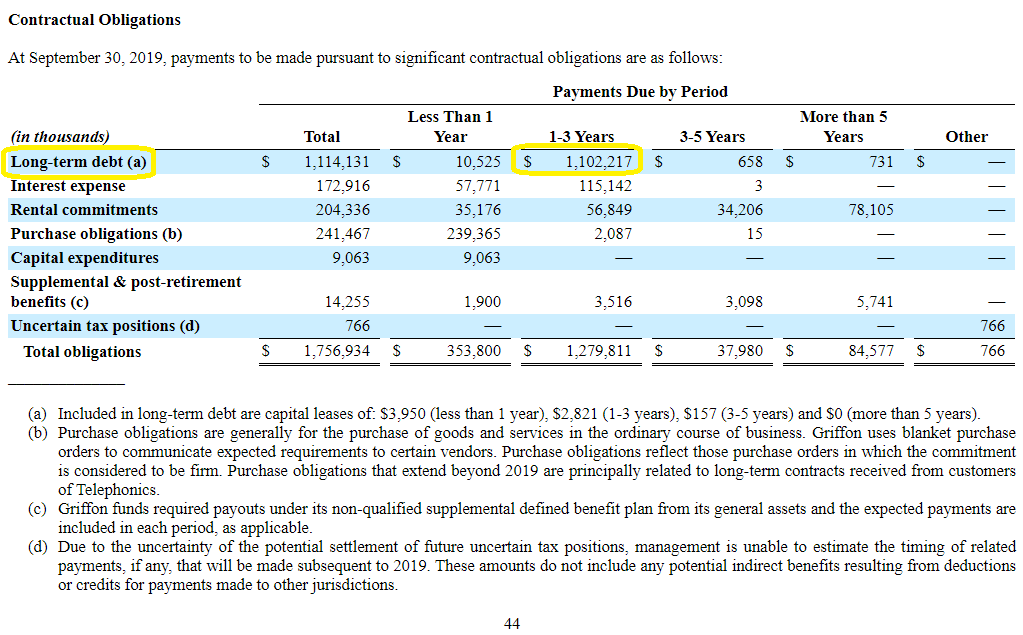

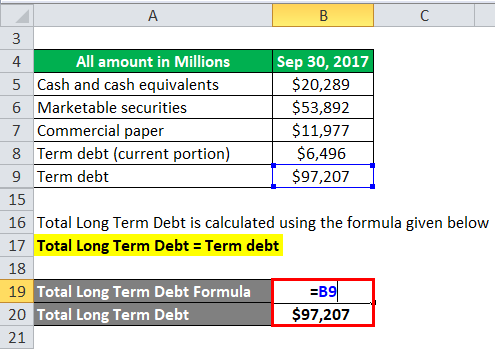

Net Debt Formula and Calculation Total up all short-debt amounts listed on the balance sheet. The formula to calculate the ratio is as follows. Net Debt-to-EBITDA Ratio Calculation.

It can easily pay off its debt. The following show two common ways to calculate CFADS. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

For Year 1 the net debt calculation is as follows. Expenses Operations maintenance land lease other labor etc. As stated earlier we calculate Net cash by deducting current liabilities Current Liabilities Current Liabilities are the payables which are likely to.

Debt-adjusted cash flow DACF is used to analyze companies in the oil and gas industry. Free Cash Flow FCF Calculator. Operating Cash Flow Net Income - Non-Cash Expenses Changes in Assets and Liabilities Working method of operating cash flow is as follows.

Maintenance Capital Expenditure CapEx Calculator. So much so that 60 of small business owners say they dont feel knowledgeable about accounting or financeBut by taking the time to. NCF total cash inflow - total cash outflow.

Expense Ratio Impact Calculator. Cash Flow Available for Debt Service CFADS Formula Definition. With the current figures in hand the accountants can also forecast the cash flow for a fixed period in the future.

Net Debt 100m in Total Debt 50m Cash. Interest Rate Parity IRP Calculator. Calculation of the Equation.

What is the Net Cash Flow Formula. Net Cash Flow 100 million 50 million 30 million. The net debt formula is calculated by subtracting all cash and cash equivalents from short-term and long-term liabilities.

Total Debt 40m Short-Term Borrowings 60m Long-Term Debt 100m. Calculation of net cash flow can be done as follows. Total all cash and cash equivalents and subtract the result from the total of.

Debt-adjusted cash flow is calculated as DACF cash flow from operations financing costs after tax. The Formula for the Cash Flow-to-Debt Ratio. Begin aligned text Cash Flow to Debt frac text Cash Flow from Operations.

What Is Net Debt Clydebank Media

Net Debt Formula And Excel Calculator

Cash Flow From Financing Activities Formula Calculations

Net Debt Learn How To Calculate And Interpret Net Debt

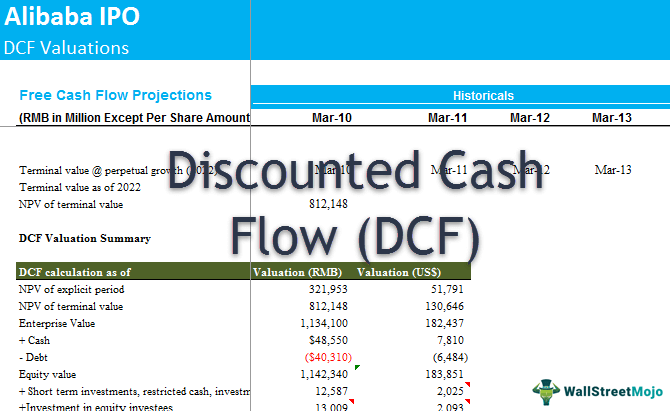

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Net Debt Formula Calculator With Excel Template

Net Debt To Ebitda Ratio Guide Formula Examples Of Debt Ebitda

Net Debt What It Is How To Calculate It And What It Tells

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Net Debt Formula And Excel Calculator

Free Cash Flow To Equity Fcfe Learn How To Calculate Fcfe

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Net Debt Formula Calculator With Excel Template

Net Debt Formula Calculator With Excel Template

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Net Debt Formula And Excel Calculator

How To Read A Cash Flow Statement Beginners Guide The Babylonians